After surging 200% over the past year, the Rolls-Royce (LSE:RR) share price is on a tear higher. At 212p, the next major level to look at is 300p. But is the business in the right shape with enough momentum to make this happen? I took a look at some charts relating to the business to try and get a clearer picture.

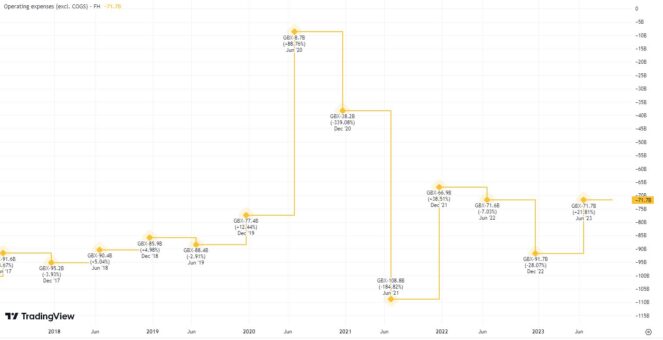

Operating costs haven’t moved

A good angle to consider is operating expenses. This focuses more on general costs of running the business. In order for Rolls-Royce to become more profitable and help to support a rise to 300p, I think it’s key to control expenses and lower them.

The chart below shows the change in operating expenses for the past few years. We can exclude the extreme financials of 2020 as the pandemic hit hard. But what I’ve noted is that expenses haven’t materially changed since 2022.

Should you invest £1,000 in Rolls-Royce right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Rolls-Royce made the list?

Source: TradingView

The CEO has made it clear that part of the transformation of the company will involve cost-cutting. I’d want to see costs move lower before getting too excited. After all, lower costs should mean a higher profit for the business.

Currently, we’d need a 41.5% move higher in the share price to reach 300p. The share price is closely linked to the profitability of the firm. So if we saw costs fall by 25% and revenue increase by 25%, it’s reasonable to think that 300p could be a price target.

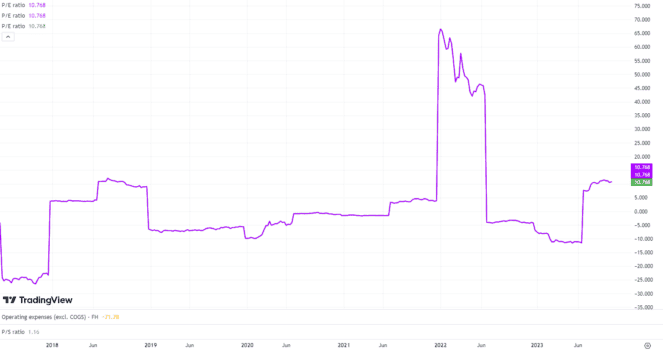

Relative value could help

As the stock isn’t overvalued, there could be room for the share price to run higher.

A good way to asses the value of a stock is via the price-to-earnings (P/E) ratio. I use a figure of 10 as a benchmark for fair value. The P/E ratio for Rolls-Royce stands at 10.78.

What this tells me is that rising earnings are supporting the rising share price.

Source: TradingView

A move to 300p could be achievable in two main ways. Earnings could improve later this year, pushing the share price higher so that the P/E ratio stays around 10. Or we could see investors presume that future earnings will be good. In this case, the stock could push higher to 300p.

If the stock hit 300p tomorrow, the P/E ratio would rise to 15.26.

In comparison to other stocks, a figure of 15.26 isn’t that high. I wouldn’t even call it overvalued. However, a concern I have is that investors might look to undervalued stocks instead of buying Rolls-Royce shares.

So even though 300p isn’t unrealistic, it could be a struggle simply because investors might look for cheaper stocks. If they spot a company with a P/E ratio of 5, it’s likely they’ll park their cash there instead.

Pulling it all together

I believe that 300p is a reasonable target for the Rolls-Royce share price to hit over the next year. If earnings per share increase, with lower expenses as a driving factor, the numbers do make sense.

However, it’s always going to be tough to convince myself to buy a stock that has jumped 200% already in the past year. The risk in the short term is that we see people taking profits and selling the growth stock.

If this happens, I’d use this drop to buy shares in the business.